Results of this EACT 2023 survey have been analyzed with the support of PwC Treasury Practice

Click here to download the full survey results (PDF)

For each of the past seven years, EACT launches its Treasury Survey to determine top priorities for corporates. It also aims to identify challenges corporate treasurers of MNCs are facing and the technological innovations they intend to implement. But the survey also aims to recognize evolutions over time and after crises. As this survey is the first since the COVID crisis ended, it was interesting to see whether priorities have changed and if they did, why. This year, EACT received circa 250 answers from group treasurers of multinational companies across Europe.

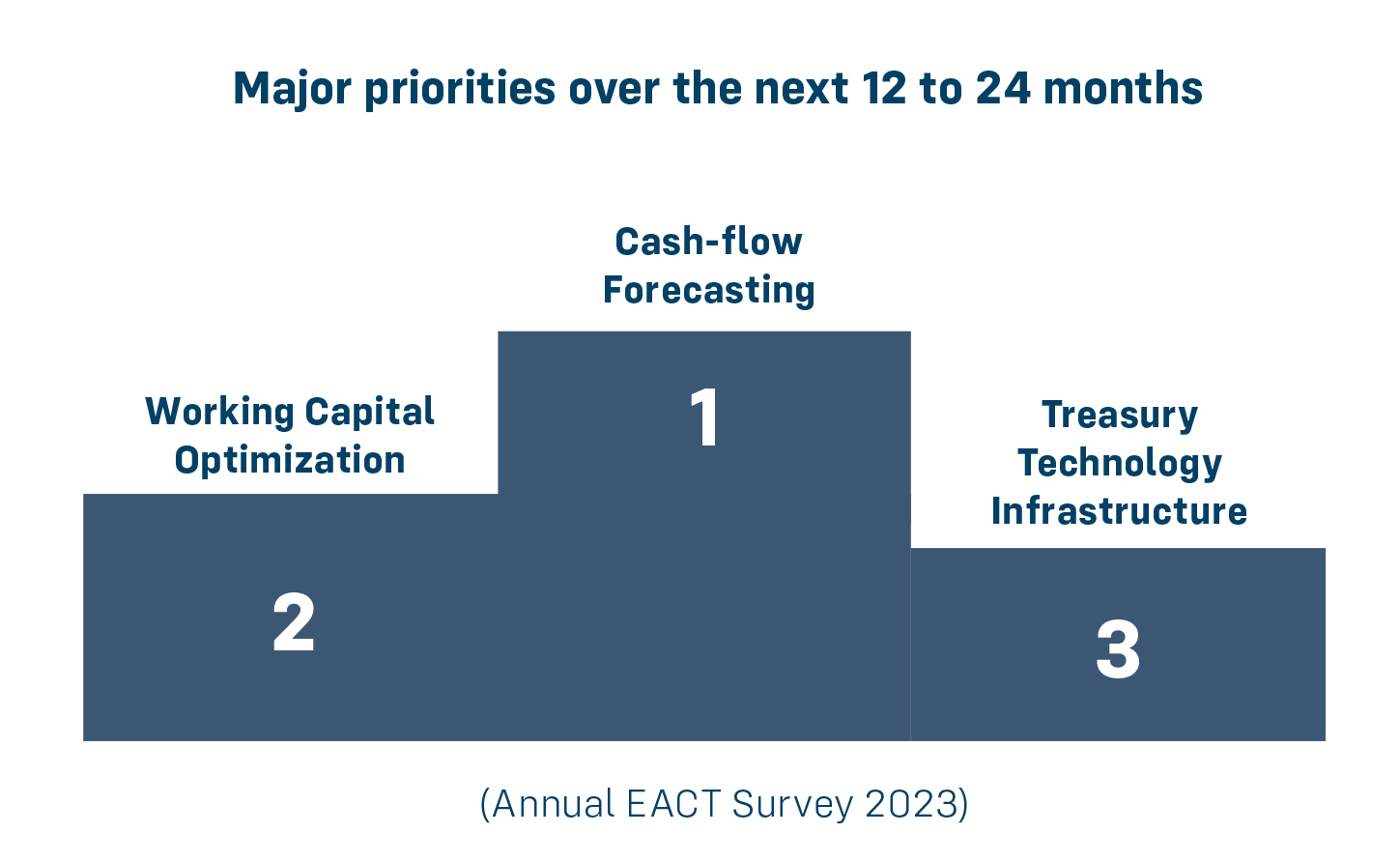

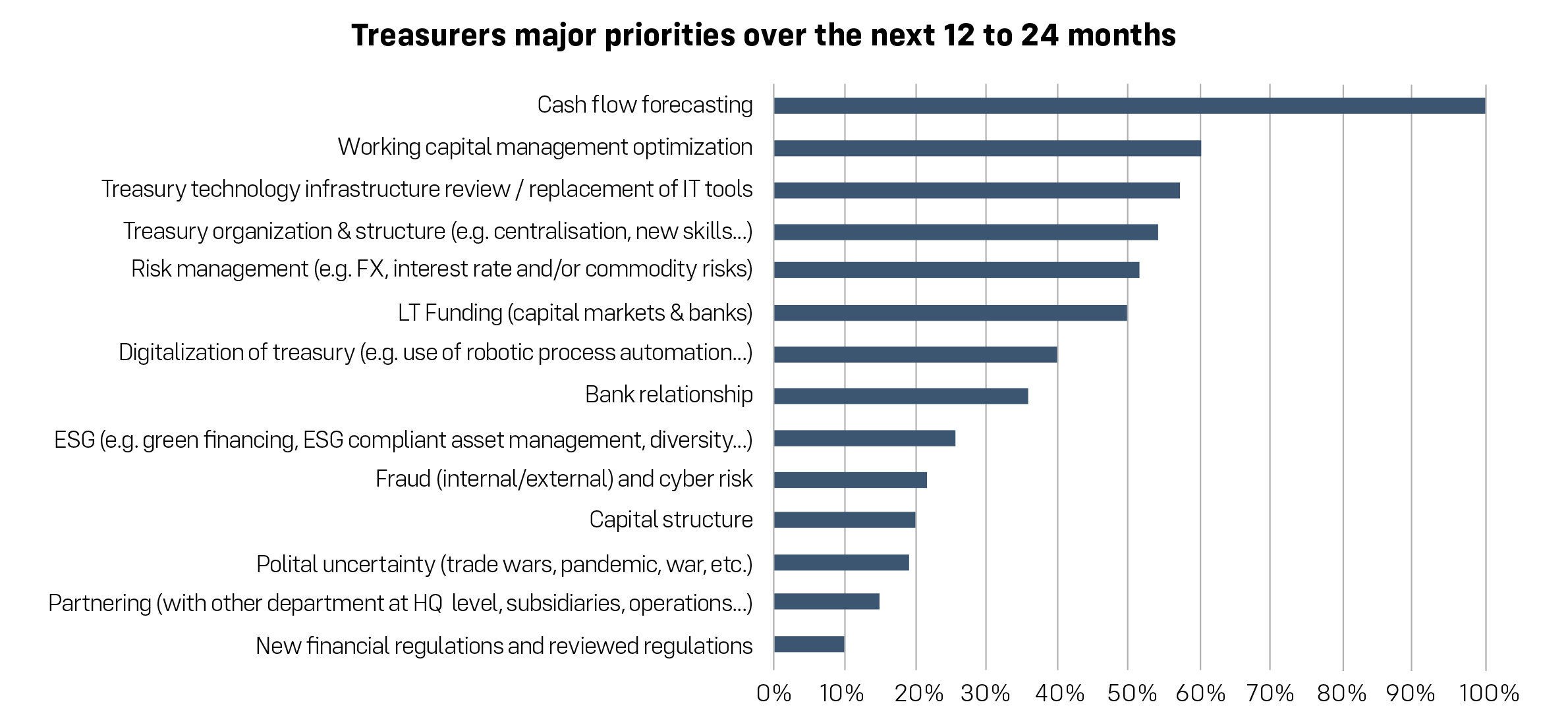

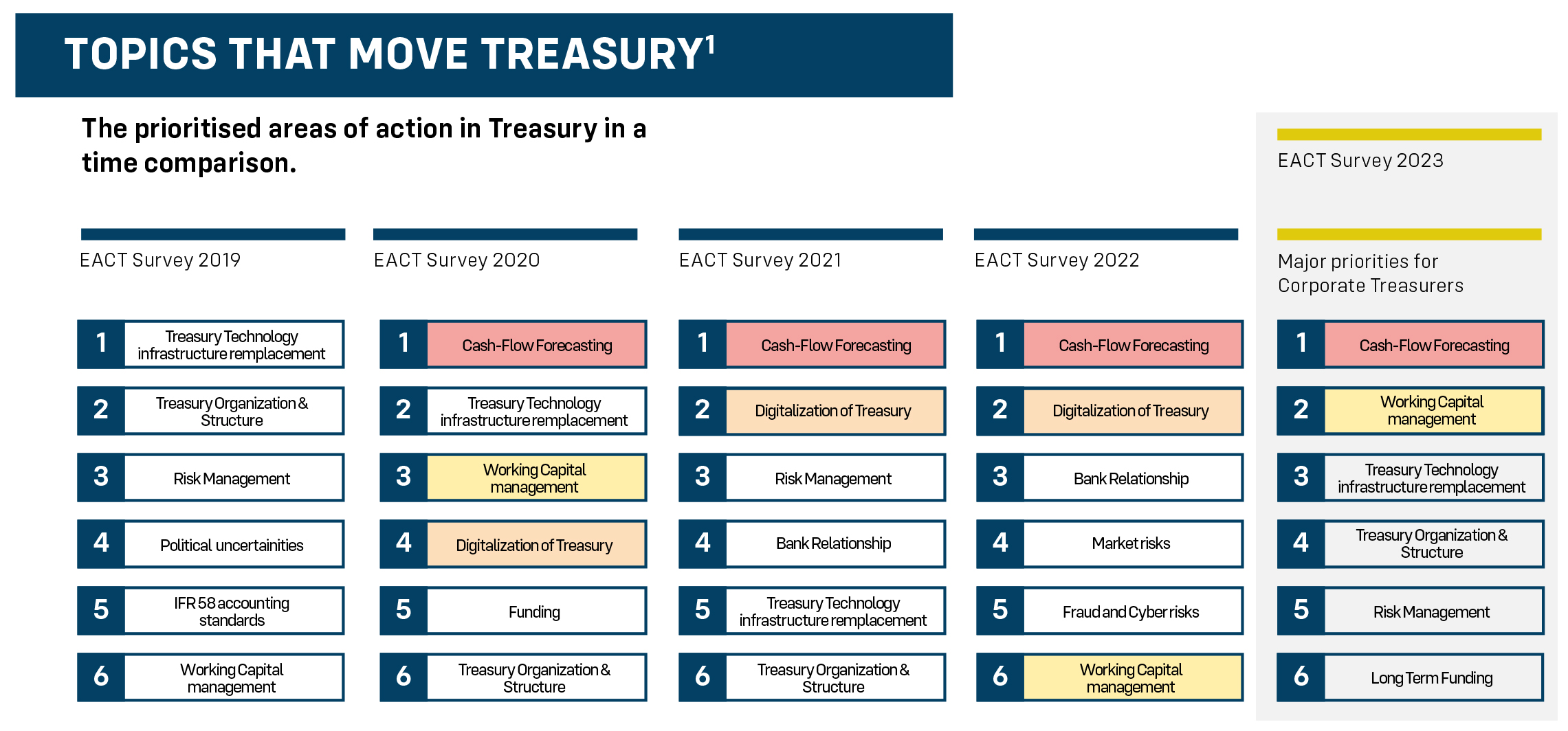

The 2023 EACT survey, as has become a tradition, attempts to detect treasury trends and priorities for multinational companies over the coming 12 to 24 months. Logically this year again, Cash-Flow Forecasting (#1) is in the lead, followed by the Working Capital Optimization (#2) and Treasury Technology Infrastructure review/replacement of existing IT tools (#3), which are quasi equal. They are then followed by a few other priorities, such as Treasury Organization & Structure (e.g. centralization, new required skills, etc.) (#4), Risk Management (e.g., FX, Interest Rate, or commodity risks) (#5), Long Term Funding (capital markets/banks) (#6), Digitization of Treasury (#7), and Bank Relationships (#8).

43,82%of Treasurers consider Cash-Flow Forecasting as their major priority |

As you can see, this year the results have changed significantly. Fundamental and pure financial issues are back at the forefront of the treasurers’ priorities. How do I secure and guarantee reliability of my cash-flow forecasting? How can I optimize my Working Capital? How should I change or modernize the complicated IT architecture I use, often after years of use without any fundamental changes? The second and third priorities have pushed bank relationships and digitization of treasury further down (NB: In the 2023 survey, please note that the digital treasury transformation has been split in two sperate categories, i.e. (A) digitization on one side and (B) treasury infrastructure review on the other side).

We may be surprised (although this can probably be explained by the pre-SBV timing of this survey) not to see Banking Relations in the top three priorities. The same is true for the Digitalization of the Treasury Function, which drops to 7th position (likely because of the split of this category in two separate ones). Finally, it should be noted that New Financial Regulations do not seem to be a priority, nor is Partnering with Stakeholders. Even Market Risk (i.e., Risk Management), which has declined from fourth to fifth position, despite the continuing sensitivity and volatility of markets. We can therefore conclude that we are facing a return to basics. Trendy topics such as ESG, financial regulations, digitalization of treasury and robotization, or fraud mitigation are seen as of secondary importance.

In terms of technological innovations, it appears that in the next 12 months, the priority will be placed on Data Analytics (#1), APIs (#2), the Cloud solution and Treasury as a Service (#3), and finally Robotics Process Automation (RPA) (#4) Artificial Intelligence & Machine Learning (#5), followed by Crypto currencies & CBDC technologies (#6). However, the ranking only slightly changed, we feel a greater appetite for the other “new technologies” in treasury. The low ranking of AI (only #5) comes from a general absence of true data lakes and standardized pieces of information. It looks like treasurers have many other technical priorities before considering these new technologies or being able to use them. They may want to first fix current systems around TMSs or review current IT architecture before using other new technologies. We all understand that the C-level wants treasury to make use of huge financial data they sit on and develop more reporting and dashboards. APIs have shown the use banks and corporates can make of them, to enrich reporting. Robotics and RPA are intermediary steps to automation, which explains their high ranking. Contrary to the recent excitement for Bitcoins and announcements around CBDC, cryptocurrencies do not seem to be a priority for treasurers. Nevertheless, it is higher ranked overtime. All-in these answers show a certain lucidity on the part of treasurers who seem realistic in their use of new technologies.

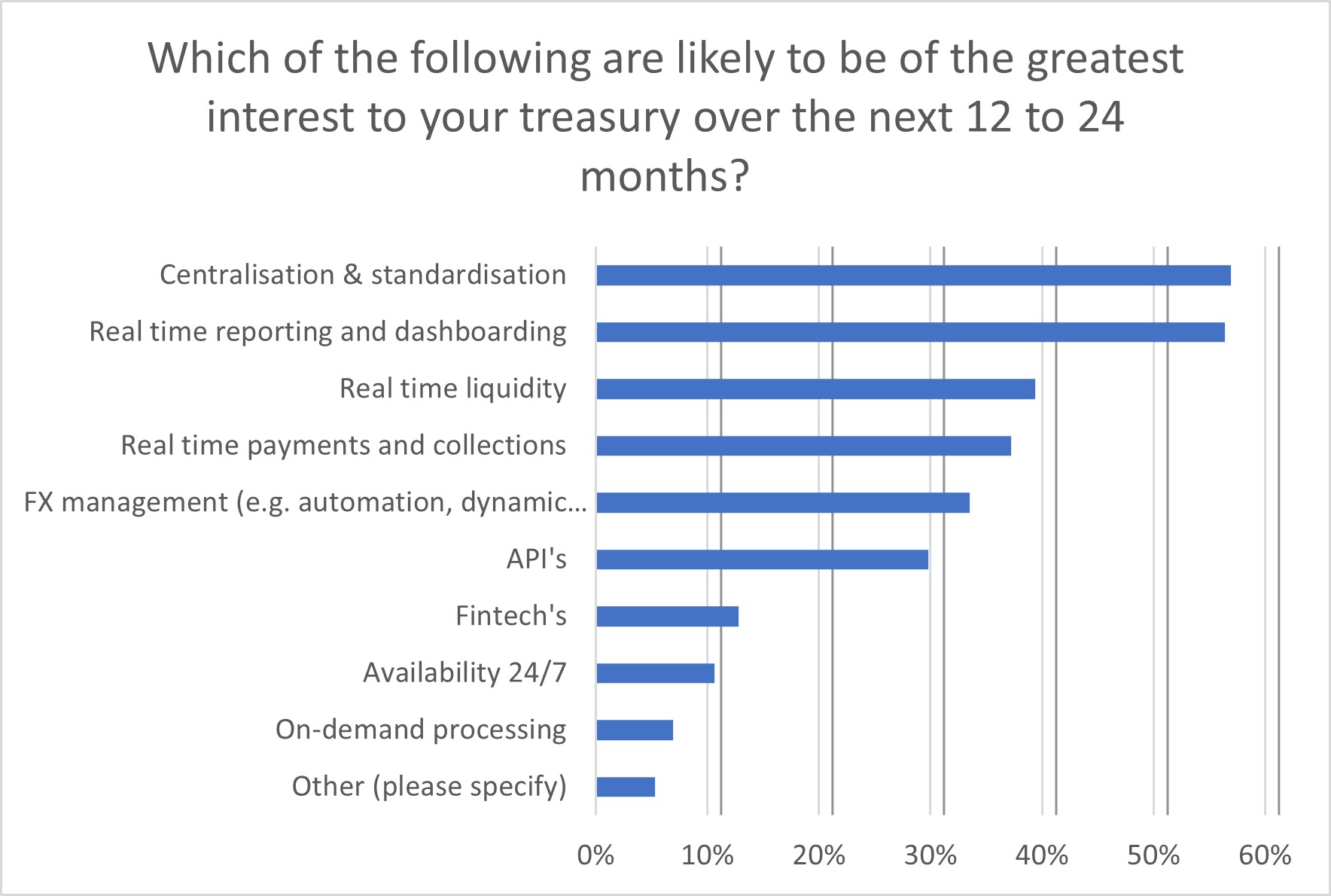

We see, surprisingly, that Centralization and Standardization are the focus for treasurers in the next 12 to 24 months (#1), followed closely by Real-time Reporting and Dashboarding (#2), and then Real-time Liquidity (#3), followed by Real-time Payments & Collections (#4), FX Automation (#5) and finally the use of APIs (Application Programming Interfaces) (#6). This demonstrates, once again, that the priorities may be more basic and simpler than imagined, as many treasurers still need to improve their day-to-day management before jumping into the use of newer technologies. The objective is immediacy - real-time for all types of information. Currency Management Automation for FX Management is also in 5th position, as here again, we seem to be far from complete and perfect automation.

On the question of which technology will be of most interest in the next 12 to 24 months, access to real-time information leads. It is followed by real-time payments and collections. This is explained by the current crisis, and the need for immediate collection to limit funding needs, or, sometimes, to simply survive (we can see that immediacy and the time factor have become crucial, at least for certain industries and B2C businesses). Real-time liquidity and finally immediate (automated) management of foreign exchange risk are also important for efficient treasury management. The fact that there still are lots of highly manual processes around FX and commodity management creates pressure for further automation to achieve greater efficiencies and internal controls. We are also surprised by the 7th position of the Fintechs with multiple innovative solutions. These Fintechs are giving a lot of hope to treasurers to change their ways of working. Things are gradually but slowly changing.

The fragmentation of IT systems in treasury and the complexity of IT architectures in many of MNCs’ treasury departments explains the importance of the risk of fraud, which has increased in recent years, and of cyber risk. Fragmentation increases these risks by a lack of fluidity, homogeneity, and sometimes consistency of the financial data to be processed. In the same vein, it is detrimental to the quality of future cash flow forecasts. The more IT solutions in use, the more difficult it becomes to consolidate data and allow systems to interact with each other, or to exchange data. The more complex the IT construction of the treasury, the more complicated the change will be/appear to be. Treasurers would like to change the IT organization but sometimes do not dare to tackle the cliff that this represents.

We know that treasury can play a significant role in working capital management. The influence or responsibility for working capital management within organizations are essential questions to address if CFOs seek to optimize it. In past surveys treasurers influenced working capital (at 50% +); were “responsible” for working capital optimization (i.e., for 20% of the treasurers); partially responsible (i.e., 20% -) or not at all responsible.

Working capital enhancement projects are always complex because they include a lot of different departments. To be successful requires solid sponsorship from the CFOs, clearly identified Project Managers, and commitment from all stakeholders. The instruments used or they plan to use in the next 12 months are the following: Payment terms; capital optimization solutions such as inventory finance, sale, and lease-back; supply chain finance enhancements, and invoice financing or dynamic discounting, cash-flow forecasting solutions or platforms; innovative payment and receivable methods (e.g., request-to-pay, link-to-pay, e-invoicing) and account receivable automation. Therefore, treasurers are back to basics. This was crystalized by the pandemic and then the war in Ukraine. CFOs try to support any initiative to enhance and optimize working capital, accessing the best funding tools at their disposal.

The question of the greatest challenge facing the treasurer is interesting in understanding what treasurers will need to prioritize. It appears that the lack of budget (#1 – 50%); the large number of bank accounts, complex group structures, and the number of legal entities (#2 - 45,7%), and difficulties in standardizing processes and weak internal controls are a major concern (#3 – 45%). Standardizing processes and internal controls remain preliminary and necessary steps to automation, improving the organization of the department, and increasing efficiency (e.g., automatic reconciliation, Straight Through Processing / STP, use of mass data, etc.). The other challenges are new financial regulations (#4), the multitude of IT tech platforms, services, fintechs, and API, and complex IT architecture (#5) followed by limited (internal) human resources (#6).

50% of respondents say the lack of budget is a major issue in further centralizing treasury activities. |

Treasurers can support ESG (Environment, Social & Governance) initiatives by issuing green bonds or other sustainable borrowing (#1); revising processes, further automation, and controls to improve sustainability (#2); investing in sustainable investment instruments (#3); in reducing business travel and encouraging work from home (#4); in setting up KPI’s for career development in under-represented groups (#5), and in donating to charities (#6). Although it seems that the ESG theme is gaining in importance, it has not yet reached its full development and maturity. Treasurers seem to underestimate the possible impression they may make on this issue.

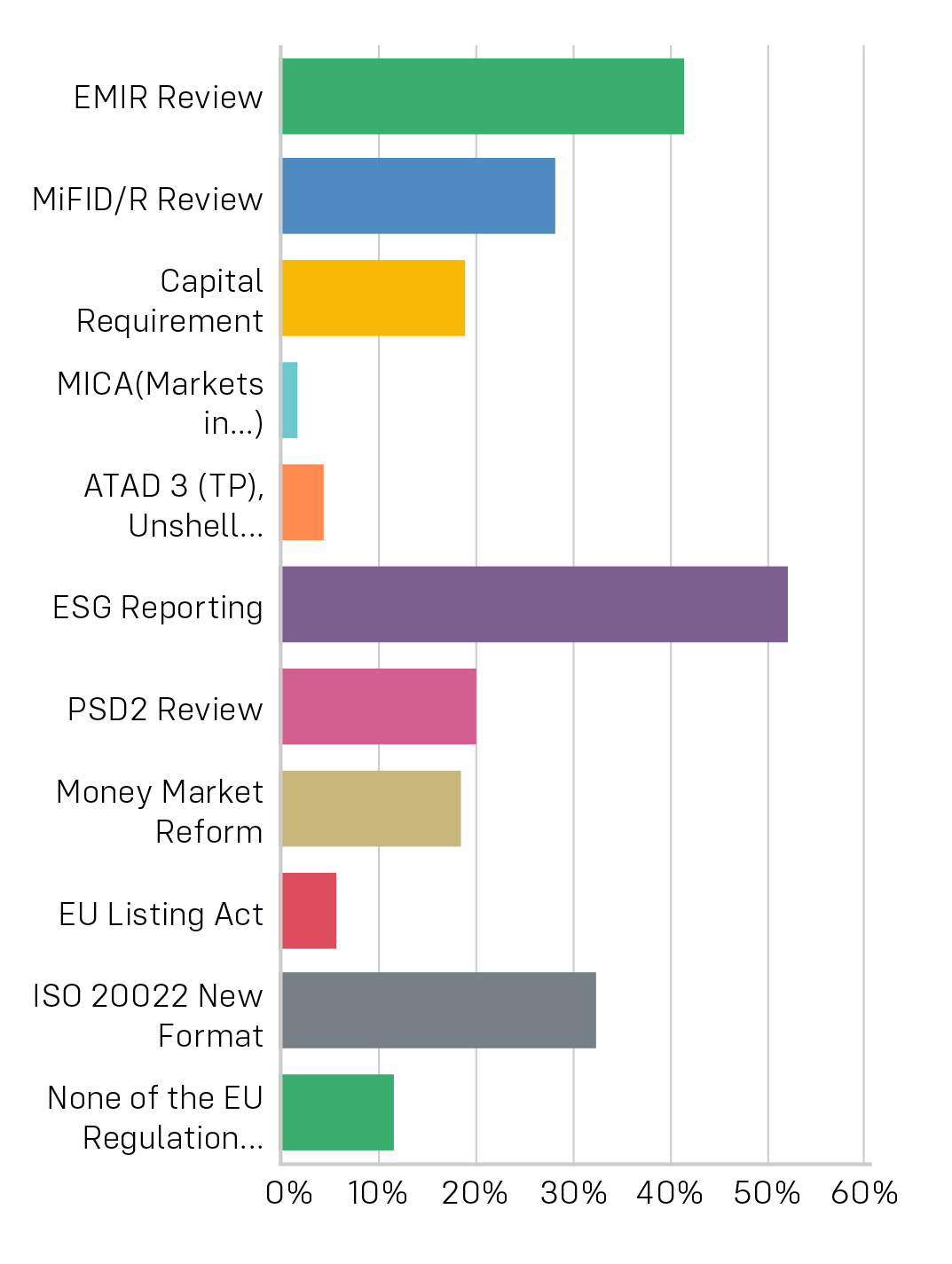

The number of financial regulations under consideration or review currently is incredibly high. Their impact could be major for treasurers. Among the most important ones identified, it appears that the priority is the ESG report (#1 – 52,2%); the EMIR review (#2 – 41,7%); the new ISO 20022 format (#3 – 32,8%); the MiFID/R review (#4 – 28,3%); the PSD2 review (#5 – 20%), and finally the adoption by the EU of the Basle rules (i.e. Capital Requirement Regulation - CRR/CRD) (#6 – 18,9%). This demonstrates the essential role that EACT can play in trying to influence and change the measures that are least acceptable to its members. It is important to make the voice of treasurers heard in Brussels to defend their interests.

In summary, the results seem to have been reinforced by the long pandemic followed by a war in Ukraine, which have confirmed the need for centralization and automation, the two best responses to such crises. The quest for further digitization and the hope placed in new technologies and innovations are explained by the importance of combating the increasing risk of fraud (ranked higher, as cyber-attacks and frauds significantly increased during the pandemic); the need for strengthening internal controls; by growing economic uncertainties; the need for more efficiency, and by a lack of sufficient (human) resources.

The crises have crystallized the need to digitize and accelerate the ongoing transformation. The maturity of technological solutions, more than ever, makes it possible to have greater expectations for improved cash management.

The challenge for treasurers comes not so much from the changes themselves, but from managing the continuum of changes, on the economic, financial, and regulatory sides. It is clear from this survey that there is still a long way to go to reach a level of mastery of new technologies, real-time operations management, and reduction of inherent treasury risks.

Despite the significant shift noticed during these recent crises to digitize and automate treasury processes wherever possible, the survey demonstrates the need for taking treasury to the next level.

François Masquelier, Chair of EACT (European Association of Corporate Treasurers)

The CEE 2025 Treasury Forum, held in Cluj-Napoca, Romania, from 15 to 17 May, gathered financial leaders from across the central and eastern European region to explore the evolving role of treasurers in today’s complex economic environment.

Read

Founded by treasury practitioners, Baltrea is driven by a vision to foster excellence, encourage collaboration, and promote innovation within the treasury community.

Read

The 2025 annual EACT Summit, held in Brussels in April, served as a timely reminder that treasurers across the community possess an increasingly welcome voice in the face of adversity.

Read.png)

The survey aims to identify challenges corporate treasurers of MNCs are facing and the technological innovations they intend to implement. It also aims to recognize evolutions over time and after crises.

Read

The fourth edition of the publication, describes basic requirements and provides guidance on establishing and developing the treasury function.

Read